DOGE Price Prediction: Analyzing the Path to $1 Amid ETF Speculation and Institutional Accumulation

#DOGE

- Technical Breakout Confirmation - Price trading above key moving averages and Bollinger Bands indicates sustained upward momentum

- Institutional Accumulation - Major acquisitions by entities like CleanCore creating significant buying pressure and reduced circulating supply

- ETF Approval Probability - 94% likelihood of ETF approval potentially bringing massive institutional capital and mainstream adoption

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Indicators

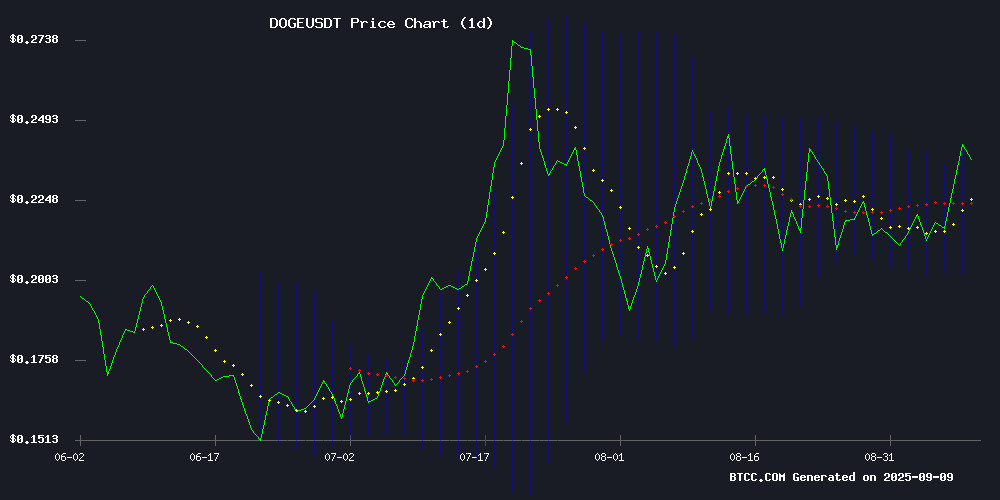

According to BTCC financial analyst Michael, DOGE is currently trading at $0.23529, comfortably above its 20-day moving average of $0.221809. The MACD indicator shows positive momentum with a reading of 0.001632, while the price sits within the upper Bollinger Band range of $0.241725, indicating potential for continued upward movement. The technical setup suggests strong support at $0.201893 with resistance NEAR $0.2417.

Market Sentiment: Extreme Bullishness Driven by Institutional Adoption

BTCC financial analyst Michael notes that recent news flow has been overwhelmingly positive for DOGE. CleanCore's massive acquisition of 285.42 million Doge and their target of reaching 1 billion tokens within 30 days demonstrates significant institutional confidence. Additionally, the 94% probability of ETF approval and mentions of treasury adoption are creating unprecedented bullish sentiment. These developments, combined with technical breakouts, suggest sustained positive momentum in the near term.

Factors Influencing DOGE's Price

CleanCore Acquires 285.42M Dogecoin and Sets Target of 1B DOGE in 30 Days

CleanCore Solutions Inc. (NYSE American: ZONE), a cleaning and disinfection firm, has made a bold entry into the cryptocurrency space by acquiring 285.42 million Dogecoin (DOGE), valued at approximately $68 million. The company aims to amass 1 billion DOGE within the next 30 days, positioning itself as the largest Dogecoin treasury holder in less than a week.

Marco Margiotta, CleanCore's Chief Investment Officer and CEO of House of DOGE, emphasized the strategic alignment with Dogecoin's growing utility and adoption. "Our treasury strategy reflects the forward-looking vision of House of Doge, where increased utility is expected to drive broader demand for DOGE as a global digital asset," he stated.

Institutional interest in Dogecoin is surging, with on-chain data revealing whales purchased over 240 million DOGE in the past 24 hours alone. This aggressive accumulation signals growing confidence in the meme coin's long-term viability.

CleanCore Solutions Surges 38% After $68M Dogecoin Acquisition

Microcap firm CleanCore Solutions (ZONE) soared 38% in after-hours trading following its $68 million purchase of 285,420 Dogecoin (DOGE). The move comes just days after the company raised $175 million from prominent investors including MOZAYYX, Pantera, and FalconX.

CleanCore plans to acquire up to 1 billion DOGE within 30 days, with ambitions to eventually control 5% of the cryptocurrency's total supply. Dogecoin itself continues its upward momentum, gaining 7% over the past 24 hours.

Dogecoin (DOGE) Price Prediction: Rally Sparks Market Optimism

Dogecoin surged 6% in an unexpected rally, reigniting trader interest as key resistance levels come into focus. Rising futures open interest and spot inflows suggest growing market conviction, with technical indicators pointing to potential extended gains.

On-chain data reveals strengthening support from both long-term holders and short-term accumulators. Glassnode metrics show the 1-2 year holding cohort expanding from 21.65% to 23.24% over the past month, while the 1-3 month group grew from 5.43% to 6.58% - a clear signal of multi-timeframe demand.

Chart analysis confirms the bullish case. The 4-hour timeframe shows a completed inverse head-and-shoulders pattern, typically signaling bearish exhaustion. A symmetric triangle breakout now projects a $0.37 target, though short-term consolidation near $0.222 support may precede any push toward $0.235 resistance.

Dogecoin (DOGE) Bull Run Alert: $0.236 Breakout Sets Stage for Strong Upside

Dogecoin has solidified its position above key moving averages, signaling a bullish trend. A decisive breakout above $0.236 could propel the meme coin toward higher targets at $0.245 and $0.256, while a close below the $0.218–$0.221 support zone would introduce downside risk.

Technical analysis reveals Dogecoin pierced the Ichimoku Kumo cloud on September 7, converting former resistance into support between $0.21517 and $0.22661. The $0.23804 level now emerges as critical resistance, marked by the Kijun-sen line. Market structure suggests the $0.23–$0.24 range will determine near-term price action.

The 20-day EMA at $0.221 continues to provide reliable support, with the 50, 100, and 200-day EMAs stacked bullishly beneath. While Ichimoku indicators show mixed signals—with a green Kumo suggesting mid-term strength but Chikou Span positioning warranting caution—the cloud breakout ultimately favors buyers.

Dogecoin Price Potential Surges as DOGE ETF Approval Odds Rise to 94%

Dogecoin's market trajectory mirrors historic bull cycles, with analysts predicting an 860% rally to $2.28 if a spot ETF gains SEC approval. Polymarket data shows 94% odds for a DOGE ETF by 2025, fueling speculative momentum.

The meme coin gained 7% in 24 hours to $0.231, with trading volume spiking 123% to $2.6 billion. Technical analysis reveals DOGE consolidating at a multi-year logarithmic support level - a pattern that preceded 1,600% gains in prior cycles.

Rex-Osprey's ETF filing has become a catalyst, though regulatory hurdles remain. The coin's 10% weekly rebound from $0.205 demonstrates retail investors' appetite for high-risk, high-reward crypto assets.

Dogecoin Price Breakout Signals Bullish Momentum With Target Around $0.32

Dogecoin surges 7.69% in 24 hours, extending an 8.6% weekly gain as bullish momentum builds. The meme cryptocurrency now trades at $0.2345 with trading volume spiking 184% to $3.12 billion.

A decisive breakout from a symmetrical triangle pattern confirms bullish control, with $0.2250 establishing as new support. Technical indicators flash green—the RSI crossing 53.32 signals growing buying pressure while the MACD confirms upward trajectory.

Traders eye immediate resistance at $0.25, with sustained momentum potentially propelling DOGE toward the $0.30-$0.32 target zone. Market capitalization swells to $35.37 billion as investor interest reignites in the iconic digital asset.

Dogecoin Price Targets 18% Breakout As Spot Flows Rise: Is $0.27 Next?

Dogecoin price held steady at $0.229, with traders eyeing a potential 18% surge toward $0.27. Spot flows shifted to outflows, signaling reduced selling pressure as holders moved coins off exchanges. The Money Flow Index reinforced bullish sentiment, suggesting accumulation at current levels.

Year-to-date gains stand at 140%, though momentum stalled in recent weeks. The sudden 5% intraday jump reflects renewed buying interest. Exchange netflows turned negative on September 8, with $7.74 million exiting platforms—a stark reversal from the previous day's $11.25 million inflow.

Technical and on-chain metrics now align for a potential breakout. The $0.229 level serves as immediate resistance, with $0.27 representing the next psychological hurdle. Market structure suggests this could be preliminary to larger moves, contingent on sustained demand.

Dogecoin Targets $0.33 on Technical Breakout Amid ETF Speculation

Dogecoin's price surged 7% in the past 24 hours as a symmetrical triangle breakout and ETF filings fueled bullish momentum. REX Shares and Osprey Funds leveraged the 1940 Act to fast-track the first DOGE ETF, potentially launching this week.

Trading volume spiked 160% as DOGE tested the $0.23 resistance level. A confirmed breakout projects a $0.33 target based on the pattern's $0.10 height. Failure to hold $0.22 risks a retracement to $0.20.

Dogecoin ETF Launch Sparks Renewed Market Interest and Price Surge

Dogecoin's price prediction is back in the spotlight as REX Shares prepares to launch the first-ever Dogecoin ETF, the REX-OspreyDOGE fund. The announcement has injected fresh momentum into DOGE, with prices rising 8% over two sessions to $0.2319. Trading volume skyrocketed 137% to $2.72 billion, pushing market capitalization to $35 billion.

Institutional interest grows as REX Shares confirms the upcoming ETF will track Dogecoin's performance, marking a milestone for the memecoin. "The REX-OspreyDOGE ETF, $DOJE, is coming soon," the firm announced, positioning it as the first fund to offer pure Dogecoin exposure.

While the ETF news fuels optimism, analysts caution that volatility may persist until DOGE establishes new highs. Meanwhile, retail investors are diversifying into emerging meme tokens, with one presale star attracting significant capital inflows in recent weeks.

Dogecoin (DOGE) Surges 7% as ETF Filing and Treasury Adoption Fuel Bullish Momentum

Dogecoin's price surged to $0.23, marking a 7% gain, as institutional interest in the meme cryptocurrency reached new heights. The rally follows two pivotal announcements: REX-Osprey's filing for a Dogecoin ETF and a $175 million treasury initiative led by House of Doge and CleanCore Solutions.

The proposed ETF, which would allocate 80% of its assets to DOGE, signals growing mainstream acceptance. Meanwhile, the treasury reserve plan mirrors corporate Bitcoin strategies from previous cycles, underscoring institutional confidence in Dogecoin's long-term viability.

Technical indicators suggest sustained upward momentum, with the MACD histogram flashing bullish signals despite a neutral RSI reading at 55.96. Market participants are now watching whether these developments will catalyze further adoption beyond retail investors.

Will DOGE Price Hit 1?

While current momentum is exceptionally strong, reaching $1 would represent a 325% increase from current levels. According to BTCC financial analyst Michael, this target appears ambitious in the immediate term but becomes more plausible when considering the combination of technical breakout patterns, institutional accumulation, and potential ETF approval. The following table outlines key milestones:

| Price Target | Increase Required | Key Catalysts |

|---|---|---|

| $0.32 | 36% | Technical breakout confirmation |

| $0.50 | 113% | ETF approval + sustained institutional buying |

| $0.75 | 219% | Mass adoption + broader market rally |

| $1.00 | 325% | Perfect storm of all bullish factors |

Michael suggests that while $1 is possible in a extended bull market scenario, investors should focus on nearer-term targets around $0.32-$0.50 as more immediately achievable based on current fundamentals.